HAL OUT OF AMCA RACE: WHAT THE SHIFT MEANS FOR INDIA’S DEFENCE AND HAL INVESTORS

HAL OUT OF AMCA RACE WHAT THE SHIFT MEANS FOR INDIA’S DEFENCE AND HAL INVESTORS

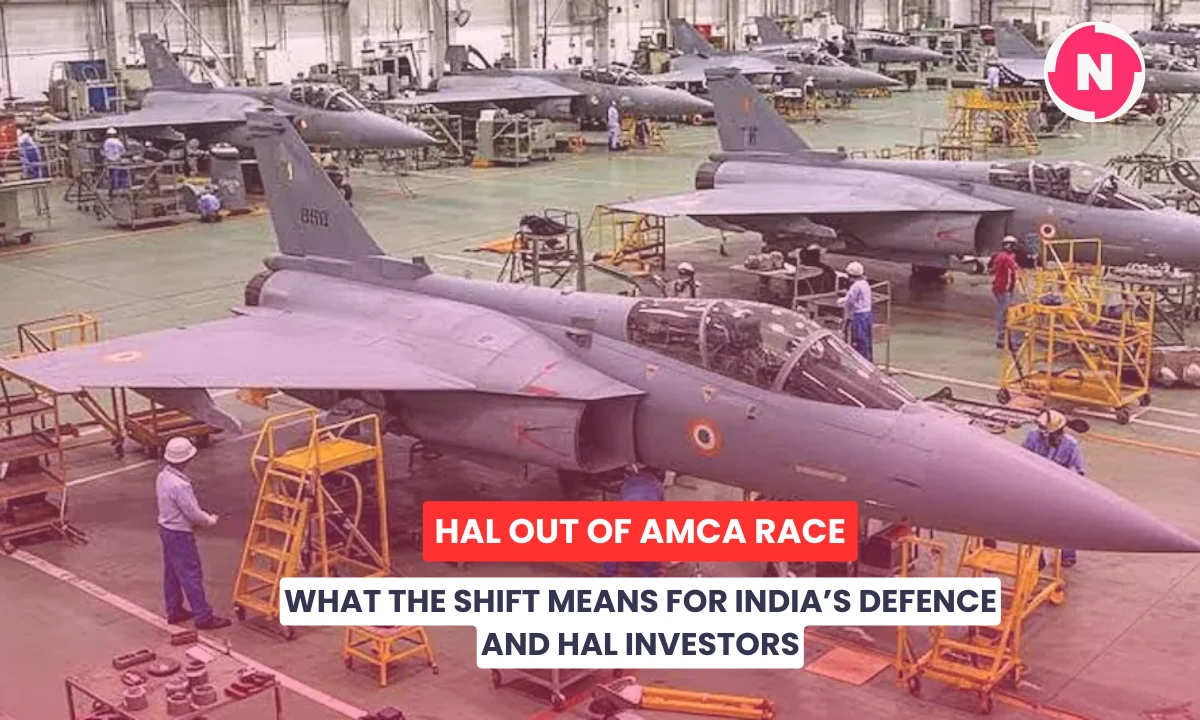

Hindustan Aeronautics Limited remains at the center of India’s defence discussion as headlines around the AMCA programme, Tejas deliveries, and sharp stock market reactions converge. The HAL keyword has seen a surge in searches after reports confirmed that the public sector aerospace major is no longer part of the Advanced Medium Combat Aircraft project, even as it reassures the Indian Air Force on Tejas Mk1A deliveries and maintains a record order book.

This development marks a structural shift in how India approaches fighter aircraft manufacturing. For decades, Hindustan Aeronautics Limited was considered the default production partner for major combat aircraft programmes. The AMCA decision challenges that assumption and has triggered debate across defence circles, investor forums, and public platforms like X.

KEY TAKEAWAYS

- HAL has been excluded from the AMCA fighter programme due to its overloaded order book.

- Private sector firms will now lead fifth generation fighter manufacturing with ADA.

- Tejas Mk1A deliveries are ready but engine supply remains the bottleneck.

- HAL shares corrected sharply following brokerage downgrades and uncertainty.

- Public opinion reflects frustration over delays but recognition of HAL’s strategic role.

WHY HAL IS OUT OF THE AMCA PROGRAMME?

The Advanced Medium Combat Aircraft programme represents India’s ambition to field a fifth generation stealth fighter with indigenous design leadership. In a departure from past practice, the government decided that HAL would not lead or participate in prototype development.

Officials involved in the selection process cited HAL’s existing commitments as the primary reason. The company’s order book is estimated at nearly seven to eight times its annual revenue. This includes Tejas Mk1A fighters, helicopter programmes, and multiple upgrade contracts. The concern was that adding AMCA would stretch execution capacity and delay timelines.

The government also signaled the need for a parallel fighter production ecosystem. By assigning AMCA to private players, India effectively creates two independent fighter manufacturing lines. One anchored by HAL with Tejas and helicopters. Another driven by private industry for next generation platforms.

WHO WILL BUILD INDIA’S FIFTH GENERATION FIGHTER?

Three private sector groups have been shortlisted to execute the AMCA prototype phase in partnership with the Aeronautical Development Agency.

The contenders include Tata as a solo bidder, a consortium led by Bharat Forge with BEML and Data Patterns, and another led by L&T with Bharat Electronics and Dynamatic Technologies. Among them, Tata has prior experience setting up a final assembly line for the C-295 aircraft in collaboration with Airbus.

The programme involves building five prototypes by 2031, with the first expected by 2028 using the GE 414 engine. Series production is planned from 2035, with the Indian Air Force projecting a requirement of at least seven squadrons.

AMCA PROTOTYPE TIMELINE OVERVIEW

| Milestone | Expected Timeline |

|---|---|

| Contract Finalisation | Mid 2026 |

| First Prototype Rollout | 2028 |

| Five Prototypes Completed | 2031 |

| Series Production Start | 2035 |

| Initial IAF Induction | Post 2035 |

TEJAS MK1A DELIVERY STATUS AND ENGINE CHALLENGE

Alongside the AMCA news, HAL issued a clarification addressing concerns around Tejas Mk1A delays. The company confirmed that five aircraft are fully ready for delivery with major contracted capabilities. An additional nine aircraft have been built and flown.

The remaining hurdle is engine availability from GE. HAL has received five engines so far and expects the supply pipeline to improve. According to the company, once engines are integrated, deliveries can proceed rapidly in coordination with the Indian Air Force.

This engine dependency has been a recurring theme in public discourse. Many defence observers argue that reliance on foreign propulsion systems continues to constrain indigenous timelines despite strong airframe and avionics capabilities.

STOCK MARKET REACTION AND INVESTOR SENTIMENT

HAL shares reacted sharply to the AMCA exclusion and brokerage downgrades. The stock fell nearly twelve percent over two sessions, with intraday declines reaching eight percent.

A major trigger was a downgrade by Morgan Stanley, which cut its target price significantly and moved the stock to an underweight rating. The downgrade cited valuation concerns, near term uncertainty, and limited upside without fresh mega orders.

At the same time, domestic brokerages maintained a more constructive long term view. Several analysts described HAL as a structural growth story supported by defence modernization, helicopter programmes, and future upgrades of legacy fleets.

KEY FACTORS IMPACTING HAL STOCK

- AMCA programme exclusion

- Tejas Mk1A delivery timelines

- Engine supply constraints

- Profit booking after strong run up

- Rupee movement affecting export outlook

PUBLIC OPINION ON X AND DEFENCE FORUMS

Conversation on X reflects a divided mood. A significant section of users expressed frustration over repeated delays and questioned whether delivery assurances would translate into execution. Some pointed out that HAL’s statements refer to major capabilities rather than full operational configurations.

Criticism also emerged around long term engine dependence and missed opportunities in indigenous propulsion development. The AMCA shift toward private players was welcomed by users who believe leaner structures could deliver faster outcomes.

At the same time, a quieter segment defended HAL’s role. These users highlighted the scale of its current workload, its contribution to self reliance under Atmanirbhar Bharat, and the complexity of managing multiple high value defence programmes simultaneously.

Investor focused posts showed caution rather than panic. Many noted that defence stocks often react sharply to news events before stabilizing, especially when order visibility remains intact.

WHAT THIS MEANS FOR INDIA’S DEFENCE ECOSYSTEM

The AMCA decision signals a broader policy evolution. India appears committed to diversifying defence manufacturing beyond a single public sector anchor. By empowering private firms in advanced platforms, the government aims to compress timelines, improve accountability, and build competitive depth.

For HAL, the shift is less about exclusion and more about consolidation. The company remains central to current generation fighters, helicopters, upgrades, and future projects like Tejas MkII and advanced rotorcraft. Its order book visibility reportedly extends into the next decade.

For private industry, AMCA represents a rare opportunity to lead a full spectrum combat aircraft programme. Success here could redefine India’s aerospace landscape for decades.

FINAL OUTLOOK ON HAL

HAL is entering a transitional phase. Short term uncertainty around AMCA and stock volatility has weighed on sentiment. However, its execution performance on Tejas Mk1A deliveries over the next few quarters will likely determine how confidence evolves.

The broader message from policymakers and the market is clear. India’s defence ambition now rests on multiple pillars rather than a single institution. HAL remains one of those pillars, but no longer the only one.

Tags: HAL, Hindustan Aeronautics Limited, AMCA fighter jet, Tejas Mk1A, Indian defence stocks, aerospace manufacturing India, defence PSU

Share This Post